You have THE OPTION to CONTROL more of your wealth and more of your cash flow.

The desired result is having more money to retain and utilize during your lifetime and more wealth to pass on to your future generations and favorite charities.

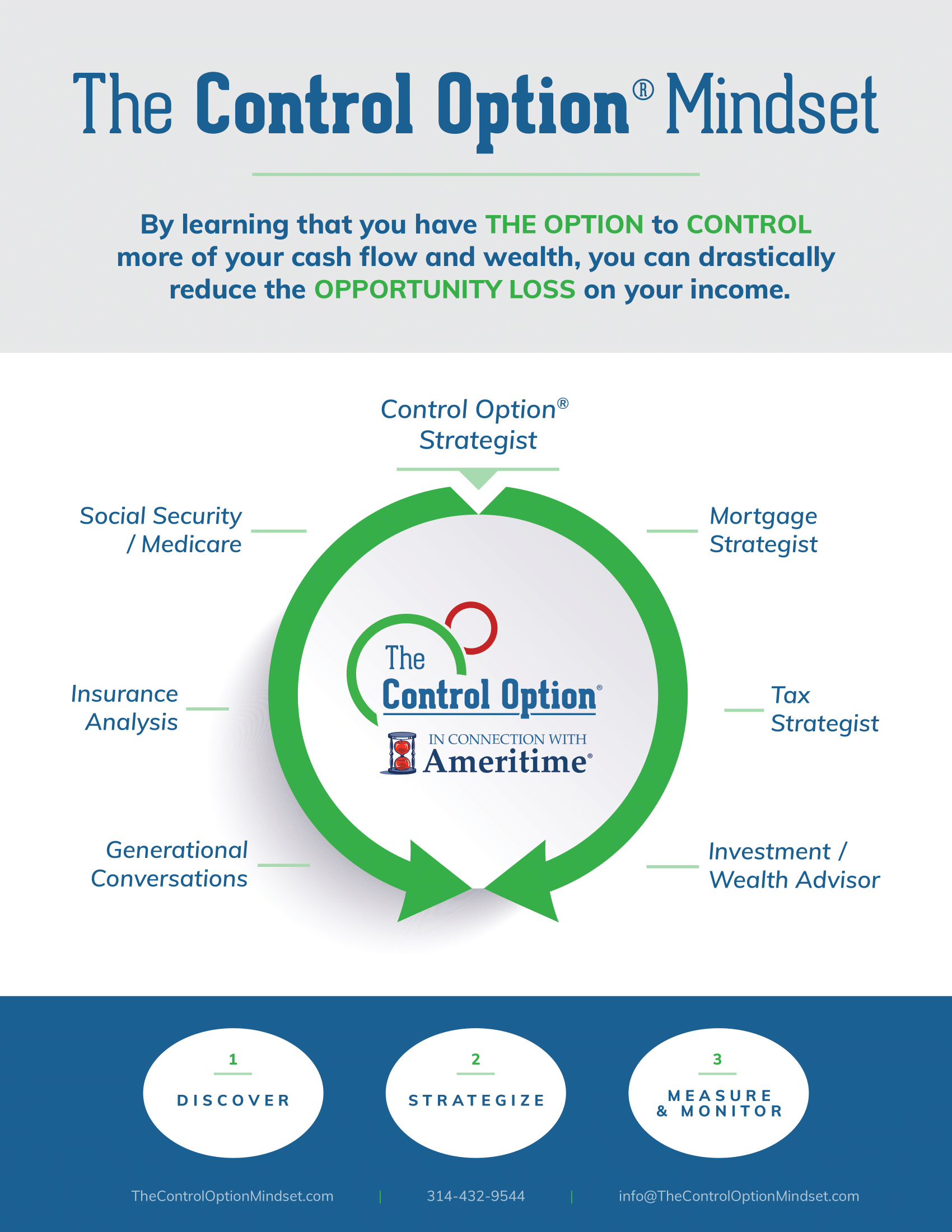

Control Option Strategist

A trained professional who, along with their Control Option Team, helps clients work through a three step process to SIMPLIFY the complications of their financial world. This three step process includes:

- Discover their COMPLETE financial picture through a series of Thinking Exercises.

- Strategize with the Control Option Team and Integrated Financial Network to help the client develop a comprehensive plan that will allow the client to save and earn a return on their cash flow before spending it.

- Measure and Monitor consistently resulting in Re-Discovering and Re-Strategizing on an ongoing basis.

And, thus enabling the client to gain greater CONTROL of their wealth and cash flow.

Insurance Analysis

The Insurance Analysis arm of our Integrated Financial Network work cohesively with the Control Option Team to develop and implement individualized and appropriate plans for clients. This incudes, but is not limited to:

- Life Insurance

- Health Insurance

- Medicare Supplements

- Property and Casualty Insurance

Generational Conversations

The Generational Conversation arm of our Integrated Financial Network blends comprehensive Estate Planning with the implementation of relationships built on mutual respect and understanding of a Family’s complete Financial Picture. The Control Option Team and Integrated Financial Network focus on developing individualized strategies, that if implored, could help clients realize how to have more dollars flow into their control to retain and utilize, now and for future generations.

Social Security/Medicare

Social Security is one of the most important and complicated financial decisions a person can make. While the programs are separate, Social Security and Medicare are intertwined in several ways. The Social Security/Medicare Strategists within our Integrated Financial Network cohesively work with the Control Option Team to help clients maximize Social Security and Medicare benefits while also being sensitive to potential tax implications.

Investment/Wealth Advisor

The Investment Advisors within our Integrated Financial Network work cohesively with the Control Option Team to make investment recommendations for clients based not only on the clients’ desires and investment experience, but also on their complete financial picture. Accumulation, Distribution and Utilization of assets and cashflow are all considered as they relate to other aspects of the financial picture including:

- Medicare Costs

- Social Security Benefits

- Estate Planning

- Tax Strategies

- Insurance Strategies

Tax Strategist

The Tax Strategists within our Integrated Financial Network work cohesively with the Control Option Team to make tax related recommendations for clients based on their complete financial picture. This includes developing short term and long term tax strategies that will allow clients to control more of their wealth and cash flow. In addition to helping you navigate the law with grace and efficiency, our Tax Strategists will work tirelessly to develop effective, ongoing plans (rather than just tax preparation). As a result, all elements of the financial picture can work together to provide a reduction of tax liability and maximization of control.

Mortgage Strategist

The Mortgage Strategists within our Integrated Financial Network work cohesively with the Control Option Team to make mortgage related recommendations for clients based on their complete financial picture. This includes developing short term and long term strategies that will allow clients to have more cash flow efficient mortgage loans and ultimately gain greater control of their money.